To download and view NEA's full report, please visit NEA's web site. The average salary of public school teachers in 2019 –20 for the State of California was $84,531.Īccording to Table B-6 of the National Education Association’s (NEA) Rankings & Estimates: Rankings of the States 2020 and Estimates of School Statistics 2021 report, California’s 2019–20 average teacher salary ranked second highest in comparison to all other states. Percentage Allocated for Teacher Salaries Percentage Allocated for Administrative Salaries School-Site Principal Annual Salary (High) School-Site Principal Annual Salary (Middle) School-Site Principal Annual Salary (Elementary)

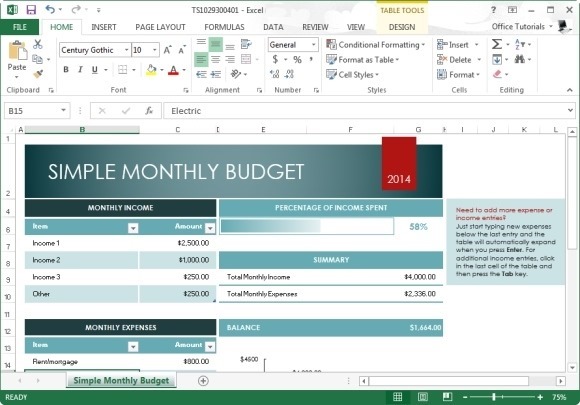

So let’s say you collect 1,200 per month in rent, and your expenses are 450 per month. Statewide Average Salaries and Expenditure Percentages for the School Accountability Report Card: 2019–20ĪDA = Average Daily Attendance Elementary School Districts When people pro-forma, or estimate the projected financials of a real estate deal, the operating expenses are typically 35 to 80 percent of the gross operating income (GOI), depending on the type of rental property.

Monthly expenses percentage of income code#

The 28/36 rule stipulates that in order for a home to be considered within your budget, your housing expenses (such as mortgage payments, taxes and insurance payments) shouldn't exceed 28% of your gross monthly income. Your total debt (including credit cards, student loans and car loan payments) shouldn't exceed 36% of your gross monthly income.The State Superintendent of Public Instruction is required by California Education Code ( EC) Section 41409(c) to provide annually to each school district, for use in the School Accountability Report Card (SARC), the statewide salary averages for teachers and administrators and the statewide percentage of expenditures spent on personnel in the following categories: Variable costs are expenses such as utility bills, credit card fees, and meals. It defined being middle class as having an annual household income from about two-thirds to double the national median, which translates to roughly 48,000 to 145,000 for a family of three (in. 1 This means the average American spends about 76 of their income. According to data from the Bureau of Labor Statistics, the average pretax household income in the United States in 2019 was 82,852, while average household expenditures added up to 63,036. To simplify further, for every dollar your company makes, five cents will go toward your lease. It may be helpful to begin by comparing your spending to what others are doing. If you're looking to buy a home, some financial experts also recommend using the 28/36 rule to determine what you can afford. For instance, if you pay 100,000 a year in rent, and your income is 2 million, your rent equals 5 percent of your income. If your job pays you 60,000 a year and you're in the 25 tax bracket, then you'll pay about 10,800 in taxes on that income, leaving you. The 30% rule is based on how much a family can reasonably spend on housing and still have enough money left over to afford everyday expenses like food and transportation. Remember, your salary is not the amount you take home. That means if you earn $75,000 a year before taxes, you should spend no more than $1,875 a month on your housing. If you own your home, you should include interest, homeowners insurance, property taxes and utilities, in addition to your mortgage. The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30% of your gross monthly income, which is your total income before taxes or other deductions are taken out.įor renters, that 30% includes rent and utility costs like heat, water and electricity.

0 kommentar(er)

0 kommentar(er)